Loading

Get Ds 5026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DS 5026 online

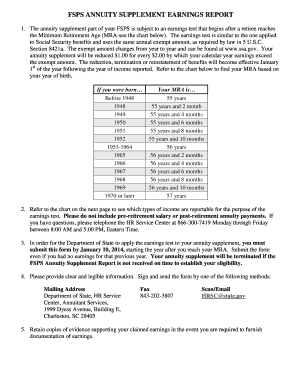

The DS 5026 is an important form used to report earnings for those receiving an annuity supplement from the Foreign Service Pension System. This guide will walk you through the steps to complete the form online accurately and efficiently.

Follow the steps to complete the DS 5026 online.

- Press the ‘Get Form’ button to obtain the DS 5026 and open it in your online editor.

- Enter your full name clearly at the top of the form in the designated field.

- Provide your Employee ID or the last four digits of your Social Security Number in the requested section.

- Indicate the year of income you are reporting in the specified box.

- Answer the first question regarding whether your annuity supplement is currently reduced or terminated due to excess earnings by marking the appropriate oval.

- If your answer is 'No' to question 1, proceed to question 2 and indicate if you had any earnings after retirement in the reported year.

- If you answered 'Yes' to question 2, enter the total earnings for the year in both the dollar and cent fields.

- Review the warning statement that clarifies the consequences of false information before proceeding.

- Sign the form in the designated area, ensuring to include your daytime phone number and email address.

- Specify the date of completion in the required mm/dd/yyyy format.

- Once all fields are completed, save your changes, then download, print, or share the form as needed according to your submission method (mail, fax, or email).

Complete your DS 5026 online today to ensure that your annuity supplement remains active!

To calculate your foreign service pension, first gather your service time and final salary information. Then, use the formulas provided by the Office of Personnel Management, which consider these factors. The DS 5026 form can aid in ensuring you have the correct details for your calculations. You can also use resources on the uslegalforms platform for additional guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.