Loading

Get Dol Payroll 2008-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DoL Payroll online

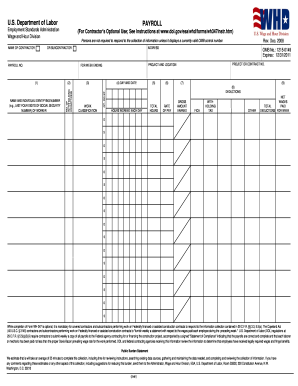

This guide provides users with comprehensive instructions on how to complete the DoL Payroll form efficiently and accurately. By following these steps, you will ensure compliance with federal wage regulations and facilitate timely payroll processing.

Follow the steps to fill out the DoL Payroll form online.

- Click the ‘Get Form’ button to obtain the document and open it for editing.

- Fill out the name of the contractor in the designated field at the top of the form.

- Enter the contractor's address to ensure accurate identification.

- Indicate the number of withholding exemptions applicable to your payroll.

- List the names and individual identifying numbers of each worker, using the last four digits of their social security number.

- Provide the work classification for each position held by the workers listed.

- Input the project or contract number, along with the project location.

- Specify the week ending date to provide the timeframe for which the payroll is applicable.

- Record the day and date for each entry of hours worked.

- Document the hours worked each day by each worker.

- Calculate and fill in the total hours worked for the week.

- Enter the rate of pay for each worker.

- Calculate the gross amount earned by each worker.

- List any deductions taken, such as FICA and withholding tax.

- Finally, determine the net wages and total paid for the week.

- Review all entries for accuracy, then save changes, download the completed form, print it if needed, or share it with the relevant parties.

Complete your DoL Payroll form online today to ensure compliance and accurate record-keeping.

Related links form

Filing for payroll involves compiling employee earnings and making necessary deductions for taxes. You can submit this information to the IRS using payroll forms such as Form 941 or others based on your situation. Consider using USLegalForms to streamline the filing process and ensure accuracy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.