Loading

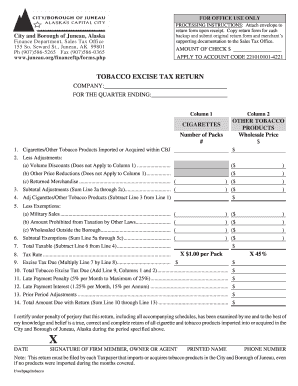

Get Tobacco Excise Tax Return Form - City And Borough Of Juneau

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tobacco Excise Tax Return Form - City And Borough Of Juneau online

Filling out the Tobacco Excise Tax Return Form accurately is crucial for compliance with tax regulations in the City and Borough of Juneau. This guide provides a clear, step-by-step approach to complete the form online, ensuring you understand each section.

Follow the steps to complete your Tobacco Excise Tax Return online.

- Click 'Get Form' button to access the Tobacco Excise Tax Return Form and open it in your preferred editor.

- In the 'Company' field, enter the name of your business or organization that is responsible for the tobacco products. This is essential for identifying the tax account related to your submission.

- Indicate the 'For the quarter ending' date. This should reflect the end date of the tax period for which you are filing the return.

- In 'Column 1', enter the wholesale price of other tobacco products. Ensure this figure reflects the accurate pricing.

- In 'Column 2', provide the number of packs of cigarettes you have imported or acquired within the City and Borough of Juneau.

- Complete Line 1 by summing the total value of cigarettes and other tobacco products imported or acquired.

- On Line 2, apply any necessary adjustments, including volume discounts and other price reductions that do not apply to Column 1.

- Calculate and enter the total adjustments on Line 3 by summing all adjustments from Line 2.

- Complete Line 4 by subtracting total adjustments from Line 1 to find the adjusted total for cigarettes and other tobacco products.

- On Line 5, list any exemptions, such as military sales or products prohibited from taxation by other laws, and enter the amounts.

- Sum the exemptions on Line 6 to determine the total exemptions applied.

- On Line 7, subtract the total exemptions from the adjusted total on Line 4 to determine the total taxable amount.

- Estimate the excise tax due by multiplying the total taxable amount (Line 7) by the tax rate indicated in Line 8.

- Add the excise tax due to any other applicable totals on Line 10 to find the total tobacco excise tax due.

- Include any late payment penalties and interest on Lines 11 and 12 as necessary.

- In Line 13, note any prior period adjustments before determining the total amount due to be filed with your return on Line 14.

- Finalize the form by signing and dating it in the certification section, ensuring all information provided is correct and complete.

- Review the completed form for accuracy and then save your changes. After this, you may download the form, print it, or share it as required.

Complete your Tobacco Excise Tax Return online today to meet your compliance obligations efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.