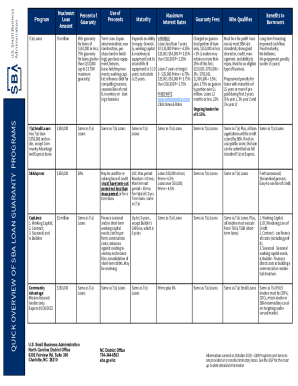

Get Sba Quick Overview Of Loan Guaranty Programs Chart 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA Quick Overview Of Loan Guaranty Programs Chart online

Completing the SBA Quick Overview Of Loan Guaranty Programs Chart online can be straightforward if you follow the right steps. This guide provides a clear and concise way to navigate the form effectively, ensuring you capture all necessary information for your loan application.

Follow the steps to fill out the SBA quick overview of loan guaranty programs chart

- Click ‘Get Form’ button to access the chart and open it in the online editor.

- Begin by entering the relevant program name you are interested in. Ensure that you have selected the appropriate loan program such as 7(a) Loans or 504 Loans based on your business needs.

- Next, input the maximum loan amount available for the selected program. Refer to the chart for specific amounts related to different loan types.

- Fill in the percent of guaranty provided for the chosen loan. This information is crucial for understanding the level of support available for your application.

- Detail the use of proceeds for the funds, ensuring to follow the guidelines for each program to qualify your intention for the loan.

- Specify the maturity terms applicable to your loan request, which can differ based on the type of loan; refer back to the chart for precise durations.

- Input the maximum interest rates related to your loan category, ensuring compliance with the provided ranges.

- List the guaranty fees that will apply to your loan. This should include the relevant percentages as detailed in the chart.

- Define who qualifies for the loan you are applying for. Check against the outlined qualifications to ensure your eligibility.

- Describe the benefits to borrowers that apply to your situation and how this loan can support your business goals.

- Finally, review your completed form for accuracy. You can then save changes, download, print, or share the form as needed.

Start filling out your SBA Quick Overview Of Loan Guaranty Programs Chart online today!

The SBA guarantee rate specifies the percentage of the loan amount that the SBA will back in the event of default. In the SBA Quick Overview Of Loan Guaranty Programs Chart, this rate can be seen as 50% to 90% depending on the program. Each guarantee rate benefits lenders by reducing their exposure, encouraging them to provide funding to small businesses. Understanding the varied rates helps borrowers choose the right loan program for their needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.