Loading

Get Form 1049

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1049 online

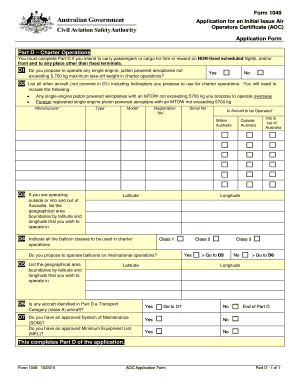

Filling out the Form 1049 online is a crucial step for individuals seeking to obtain an Air Operators Certificate. This guide will provide you with systematic instructions to complete Part D, specifically tailored for charter operations.

Follow the steps to complete Part D of the Form 1049.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section D1, indicate whether you propose to operate single engine, piston powered aeroplanes with a maximum take-off weight not exceeding 5,700 kg in charter operations by selecting 'Yes' or 'No'.

- In Section D2, list all other aircraft you intend to use for charter operations, including helicopters. Provide details such as manufacturer, type, model, registration number, serial number, and confirm if the aircraft will be operated within or outside of Australia.

- In Section D3, if operating outside or into and out of Australia, specify the geographical area boundaries using latitude and longitude coordinates.

- In Section D4, indicate the balloon classes you will use in charter operations (Class 1, Class 2, Class 3) and specify if you propose to operate balloons on international operations by selecting 'Yes' or 'No'.

- Complete Section D5 by providing the geographical boundaries for balloon operations using latitude and longitude, if applicable.

- In Section D6, indicate whether any aircraft listed in Part D qualifies as a Transport Category (class A) aircraft by selecting 'Yes' or 'No'.

- In Sections D7, answer whether you have an approved System of Maintenance (SOM) and a Minimum Equipment List (MEL) by selecting 'Yes' or 'No' for each.

- Once all relevant sections are completed, ensure to review your entries for accuracy before saving your changes, downloading, printing, or sharing the completed form as needed.

Complete your Form 1049 online today to streamline your application process.

Related links form

Form 1040 is the standard individual income tax return form used in the United States. You can access it through the IRS website, where you can download the form or complete it online. Having Form 1040 is essential for filing your taxes accurately, especially when you need to refer to it alongside Form 1049 for a comprehensive understanding of your financial situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.