Loading

Get Ssa-l725-f3 2012-2025

This website is not affiliated with any governmental entity

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SSA-L725-F3 online

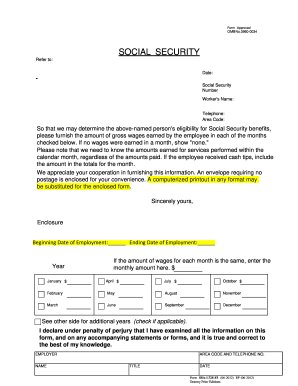

The SSA-L725-F3 form is essential for determining a user's eligibility for Social Security benefits by providing necessary wage information. This guide will take you through the process of filling out the form online in a clear and supportive manner.

Follow the steps to successfully complete the SSA-L725-F3 form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor for completion.

- Begin by entering the worker's Social Security number at the designated field. Ensure the number is correct to avoid processing delays.

- Next, fill in the worker's name and telephone number with the area code. This information is crucial for any follow-up communications.

- Indicate the employment period by entering the beginning and ending dates of employment. This helps to contextualize the wage information provided.

- For each month listed on the form, enter the gross wages earned by the employee. If wages were earned in a month, include the amount; if none, write 'none'.

- For users who receive consistent monthly wages, you may enter the total monthly amount in the designated field to save time.

- Verify the information entered on the form to ensure accuracy. This is essential as incorrect information may affect the eligibility determination.

- Once all fields are completed and checked, save your changes, and choose to download, print, or share the completed form as necessary.

Complete your SSA-L725-F3 form online today for accurate and timely Social Security assistance.

If the employer fails to provide SSA with corrected reports or information that shows the wage reports filed with SSA are correct, SSA will ask IRS to investigate the employer's wage and tax reports to resolve the discrepancy and to assess any appropriate reporting penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.