Loading

Get Al Form Fdt-v 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL Form FDT-V online

Filling out the AL Form FDT-V online can simplify the process of submitting your fiduciary income tax payment. This guide provides clear, step-by-step instructions tailored to assist users in completing the form accurately and efficiently.

Follow the steps to complete the AL Form FDT-V online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

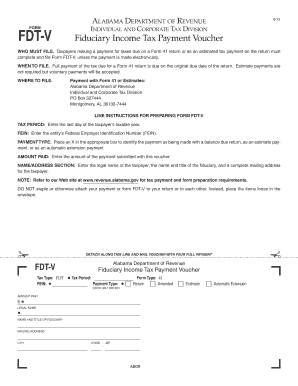

- Enter the last day of the taxpayer’s taxable year in the 'Tax Period' section.

- Input the entity's Federal Employer Identification Number (FEIN) in the designated field.

- Indicate the payment type by selecting one of the options: balance due return, estimate payment, or automatic extension payment.

- Specify the amount you are paying by entering the amount in the 'Amount Paid' section.

- Provide the legal name of the taxpayer, the name and title of the fiduciary, and a complete mailing address for the taxpayer in the 'Name/Address Section.'

- Ensure that all entries are typed and not handwritten, as this is necessary for processing.

- Use the 'PRINT FORM' button to generate a two-dimensional (2D) barcode to improve processing efficiency.

- After reviewing the form for accuracy, you can save changes, download, print or share the filled-out form.

Complete your tax documents online today to streamline your filing process.

To file an income tax return form, start by gathering all necessary documents including W-2s, 1099s, and other income statements. You can use the AL Form FDT-V for adherence to Alabama state requirements. Platforms like US Legal Forms can simplify this process and provide guidance on filings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.