Get Sba 2301 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA 2301 online

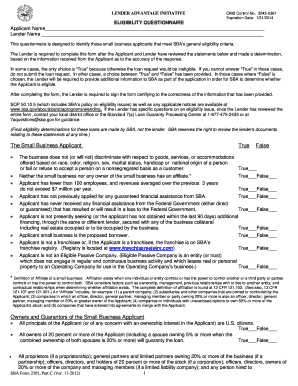

The SBA 2301 form is an essential eligibility questionnaire designed for small business applicants seeking financial assistance through the Small Business Administration. This guide provides clear, step-by-step instructions for filling out the form online, ensuring you meet all the necessary requirements and submit a complete application.

Follow the steps to successfully fill out the SBA 2301 online

- Click the ‘Get Form’ button to obtain the SBA 2301 form and open it in your preferred online editor.

- Begin by entering the applicant's name in the designated field at the top of the form.

- Next, enter the lender's name in the appropriate section.

- Review the eligibility statements presented in the questionnaire. For each statement, select either 'True' or 'False' based on the applicant's circumstances.

- Ensure that all 'True' selections are accurate, as they are critical for determining eligibility. If you select 'False', be prepared to provide additional information to the SBA.

- In the section regarding ownership and affiliation, ensure all information pertains to the owners of 20 percent or more of the applicant.

- Complete the personal resources test section, making sure liquid assets are accurately reported and the exemption amounts are calculated based on the total financing package.

- Fill out the use of proceeds section, confirming that the requested loan will not be used for activities specified in the questionnaire.

- If applicable, indicate if the loan is a Community Advantage loan and answer any related questions.

- Finally, sign the form to certify that the information provided is complete and accurate. After filling out the form, you can save changes, download, print, or share it as needed.

Take the next step toward securing financial assistance by completing the SBA 2301 online today!

Get form

Filling out a financial statement begins with collecting accurate financial data, including income, expenses, assets, and liabilities. Clearly categorize each item to improve transparency and understanding. Be meticulous with your details to avoid errors, as these statements may be reviewed by lenders or the SBA. Utilizing the SBA 2301 guidelines can greatly assist in this process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.