Get Schedule 11

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SCHEDULE 11 online

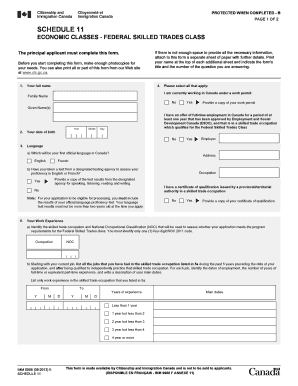

Completing the SCHEDULE 11 form is an essential step for individuals applying under the Federal Skilled Trades Class. This guide provides clear, step-by-step instructions to assist you in accurately filling out the form online, ensuring you submit a complete application.

Follow the steps to successfully complete the SCHEDULE 11 form.

- Click ‘Get Form’ button to access the form and open it in your preferred editing platform.

- Input your full name as it appears on official documents. Ensure you provide both family and given names clearly.

- Enter your date of birth by filling in the year, month, and day fields accurately.

- In section 4, indicate whether you are currently working in Canada under a work permit by selecting 'Yes' or 'No.' If applicable, attach a copy of your work permit.

- Next, indicate if you have an approved offer of full-time employment in Canada for at least one year in a skilled trade occupation. Again, choose 'Yes' or 'No' and provide relevant documentation if applicable.

- Specify your first official language in Canada and confirm whether you have taken an approved language assessment test. If you have, attach a copy of your test results.

- In section 5, note whether you possess a certificate of qualification issued by a provincial or territorial authority. Select 'Yes' or 'No' and provide a copy if 'Yes.'

- List the skilled trade occupation and corresponding National Occupational Classification (NOC) code that you will use to support your application. This is critical for assessing your application.

- Detail your work experience. Starting with your current job, document all relevant positions held in the last five years. Indicate employment dates, years of experience, and a brief description of your main duties for each role.

- Continue providing your work experience information as outlined in the form, completing any additional sections if necessary.

- Finally, input your total assets, liabilities, and settlement funds, ensuring the amounts are accurately reported in Canadian dollars.

- Review your completed form carefully for any errors or omissions, then save your changes. You may download, print, or share the form as needed.

Begin completing your SCHEDULE 11 form online today to secure your application process.

Section 37 of SCHEDULE 11 outlines essential tax guidelines for newly established companies, focusing on deductions and credits applicable to start-ups. This section is invaluable for new business owners looking to optimize their tax filings. By adhering to these guidelines, you can potentially reduce your taxable income and improve your overall financial position. Consult tax experts or reliable resources for detailed insights on leveraging this section effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.