Loading

Get T2004 E

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T2004 E online

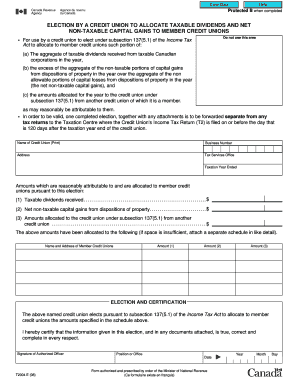

This guide provides clear and concise instructions on how to effectively complete the T2004 E form. Designed for credit unions, this document outlines the process of allocating taxable dividends and net non-taxable capital gains to member credit unions.

Follow the steps to complete the T2004 E form online.

- Press the ‘Get Form’ button to access the T2004 E online form and open it in the designated editor.

- In the section labeled 'Name of Credit Union,' print the full legal name of your credit union.

- Enter the Business Number associated with your credit union in the appropriate field.

- Fill in the address of the credit union, including street address, city, province, and postal code.

- Specify the Tax Services Office where your credit union files its returns.

- Indicate the taxation year that has ended by entering the relevant date.

- In the amounts section, record the following values as applicable: (1) the total taxable dividends received; (2) the net non-taxable capital gains from property dispositions; and (3) any amounts allocated to your credit union from another credit union.

- List the names and addresses of member credit unions in the designated area, along with the corresponding amounts for taxable dividends and net non-taxable capital gains.

- Sign and date the form in the 'Election and Certification' section, ensuring that an authorized officer completes this.

- Review the completed T2004 E form for accuracy, then save your changes, download, print, or share the document as needed.

Complete and file your T2004 E form online today to ensure compliance and accurate reporting.

To do eFiling, you need to select the relevant form, such as the T2004 E, and complete it online. Begin by entering all required information accurately on a platform like US Legal Forms. Once you review your submission, submit the form electronically for processing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.