Loading

Get Gst/hst Info Sheet Gi-144

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GST/HST Info Sheet GI-144 online

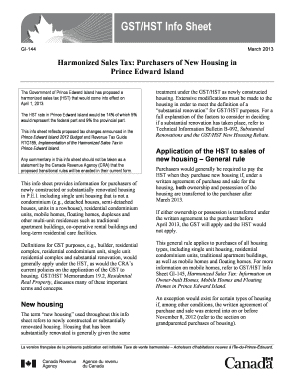

The GST/HST Info Sheet GI-144 is a key document for purchasers of new housing in Prince Edward Island. This guide provides clear and supportive instructions to help users fill out the form effectively and efficiently.

Follow the steps to complete the GST/HST Info Sheet GI-144.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out the personal information section. Ensure that you provide your full name, address, and contact details accurately as this information is essential for identification purposes.

- Next, proceed to the housing purchase details section. Here, you will need to enter the date of the agreement of purchase and sale, as well as the specific type of housing being purchased, whether it is a single unit, condominium, or other multi-unit residence.

- In the next section, specify the ownership and possession transfer dates. It is crucial to note both the dates, as they determine the applicability of the HST under the new rules.

- If applicable, include any additional notes regarding upgrades or modifications to the housing. This can affect the tax treatment, so be precise.

- Review all provided information for accuracy. Ensure that all fields are completed, as incomplete forms may lead to processing delays.

- Once all information is accurate and finalized, you can save changes, download a copy, print the form, or share it as needed.

Complete your GST/HST Info Sheet GI-144 online today to ensure compliance and avoid delays.

Many goods and services are exempt from GST in Canada, according to the GST/HST Info Sheet GI-144. Generally, basic groceries, healthcare services, education, and certain financial services do not attract GST. Additionally, residential rent and most child care services fall under the exempt category. For a comprehensive understanding of exemptions, refer to the GST/HST Info Sheet GI-144, which provides detailed information and clarity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.