Loading

Get T2076 E

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T2076 E online

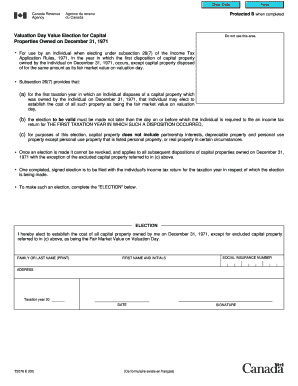

The T2076 E form is essential for individuals electing to establish the cost of specific capital properties as their fair market value on valuation day. This guide provides clear steps to assist users in completing this form online efficiently and accurately.

Follow the steps to complete the T2076 E form online.

- Press the ‘Get Form’ button to access the T2076 E form and open it in your preferred editor.

- Begin filling out the Election section by clearly stating your intent. Indicate your election to establish the cost of all capital properties owned by you on December 31, 1971, excluding certain exceptions.

- In the 'Family or Last Name' field, enter your surname in uppercase letters to ensure clarity and legibility.

- Next, fill in your 'First Name and Initials' to accurately identify yourself.

- Provide your 'Social Insurance Number' as it is crucial for tax identification purposes.

- Complete the 'Address' field with your current mailing address, ensuring it is accurate for correspondence.

- Specify the taxation year in the provided space, ensuring it corresponds to the year of the first disposition of capital property.

- Sign and date the form in the designated areas, confirming that all information provided is accurate and complete.

- Once you have finished filling out the T2076 E form, save your changes. You may then choose to download, print, or share the document as needed.

Complete your T2076 E form online today for a smooth filing experience.

To work out a gross income, start by totaling every income source received within the year. This includes salary, bonuses, and income from investments. Once completed, you will have a clear figure to present on your T2076 E, ensuring your tax calculations are precise.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.