Loading

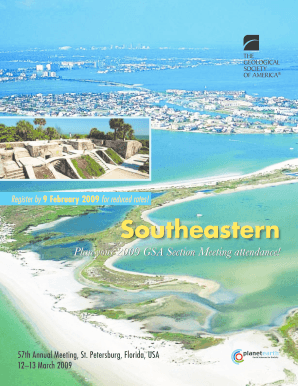

Get Register By 9 February 2009 For Reduced Rates

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Register By 9 February 2009 For Reduced Rates online

This guide provides clear and supportive instructions on how to complete the Register By 9 February 2009 for Reduced Rates form online. Whether you are a seasoned attendee or registering for the first time, following these steps will ensure a smooth process.

Follow the steps to easily complete your registration online.

- Press the ‘Get Form’ button to access the registration form. This will open the form in your preferred editing environment.

- Begin by entering your personal information accurately in the designated fields. This typically includes your name, contact details, and affiliation.

- Select your registration category. Choose from options such as Professional Member, Student Member, or Guest, based on your status.

- Indicate your preferred payment method. Options may include credit card or invoice, according to the form's layout.

- Review all entered information for accuracy. Ensure no fields are left incomplete and all selections accurately reflect your choices.

- Once completed, you can save the changes made to the form. Be sure to download a copy of your registration for your records.

- Finally, submit your form. You will have options to either print the form for offline submission or share it via email if applicable.

Complete your registration online before the deadline to secure your reduced rates!

The partial exemption de minimis rule allows businesses to reclaim VAT if their exempt sales are below a certain threshold. This can simplify the recovery process and reduce administrative burdens. It's beneficial for small businesses making minimal exempt sales. To take advantage of possible savings, make sure you Register By 9 February 2009 For Reduced Rates to engage with this tax relief option.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.