Loading

Get Inherited Roth Ira Simplifier®

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Inherited Roth IRA Simplifier® online

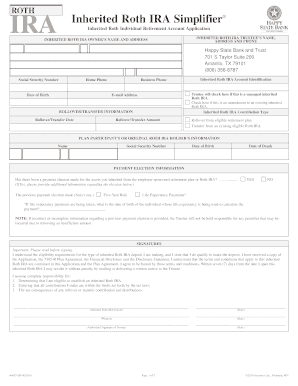

Filling out the Inherited Roth IRA Simplifier® can be a vital step in managing your inherited assets effectively. This guide will provide you with comprehensive, step-by-step instructions on how to complete the form online, ensuring you understand each important component.

Follow the steps to complete your Inherited Roth IRA Simplifier® online.

- Press the ‘Get Form’ button to acquire the Inherited Roth IRA Simplifier® and open it in your editing interface.

- Begin by filling in the inherited Roth IRA owner's name and address. Ensure that all information is accurate and current.

- Provide the trustee's name, address, and phone number. Include details such as the social security number and date of birth of the trustee.

- Indicate whether this inherited Roth IRA is a managed account by checking the appropriate box.

- Fill out the rollover/transfer information, including the transfer date, account identification, and amount being transferred.

- Complete the original Roth IRA holder’s information, providing their name, social security number, date of birth, and date of death.

- In the payment election section, specify whether a payment election has been made regarding the inherited assets. Provide further details if applicable.

- Read through the signature section carefully. Confirm your understanding of the eligibility requirements and responsibilities outlined regarding the inherited Roth IRA.

- Save your changes. You have options to download, print, or share the completed form depending on your needs.

Get started on completing your Inherited Roth IRA Simplifier® online to manage your inherited assets effectively!

An inherited Roth 401k offers various options, including cashing it out, rolling it over to an inherited IRA, or leaving it in the plan. Beneficiaries need to consider the implications of each choice, especially regarding taxes and withdrawal rules. The Inherited Roth IRA Simplifier® can help clarify your options and guide your decision-making.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.