Get Business Loan Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BUSINESS LOAN APPLICATION online

Completing a business loan application online can be a straightforward process when you have clear guidance. This document outlines each necessary component, ensuring you provide accurate information to meet your financial needs effectively.

Follow the steps to complete your application successfully.

- Click ‘Get Form’ button to obtain the application and open it in your preferred online format.

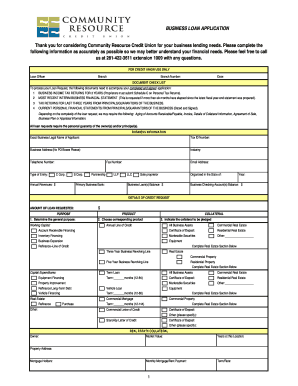

- Fill in the business information section. This includes the exact legal name of your business, tax ID number, business address (no P.O. boxes), industry, telephone number, type of entity, email address, organized state, and annual revenues.

- Provide details on existing business loans by entering the balance and year of each loan.

- Complete the 'Details of Credit Request' section, specifying the amount of loan requested and its general purpose. Select the corresponding product and indicate what collateral will be pledged.

- Fill out the real estate collateral section if applicable. Include the owner, market value, years at location, monthly mortgage/rent payment, and property address.

- Provide management and ownership information for principal owners. This includes names, management titles, years as owners, and ownership percentage.

- Answer the miscellaneous questions regarding endorsements, claims, any financial debts, and bankruptcy declarations if applicable.

- List all business debts clearly, providing creditor names, balances, payment amounts, frequency, interest rates, and collateral associated with each debt.

- Review any necessary disclosures regarding rights to receive an appraisal report and equal credit opportunity information.

- Certify the application by providing the necessary signatures of all applicants, dating it accordingly.

- Finally, save changes, download, print, or share the completed application as needed.

Start your journey by completing your BUSINESS LOAN APPLICATION online today!

Applying for a business loan generally involves several important steps. First, you will need to complete a comprehensive BUSINESS LOAN APPLICATION, which includes providing your business details and financial information. Once submitted, lenders will review your application, assess your qualifications, and consider factors like your credit history. Platforms like US Legal Forms provide templates to simplify this process, ensuring you include all necessary documentation for a smooth review.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.