Loading

Get Credit Application Disclosures

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Credit Application Disclosures online

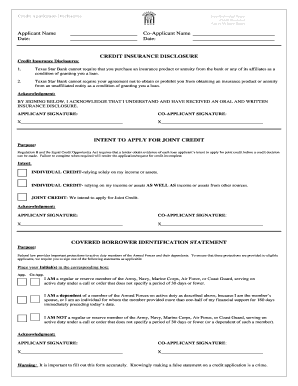

Filling out the Credit Application Disclosures is an essential step in the process of applying for credit. This guide aims to provide clear, step-by-step instructions that make it easy to complete the form online while ensuring you include all necessary information.

Follow the steps to successfully complete your application.

- Click the ‘Get Form’ button to access the Credit Application Disclosures document and open it in your web browser.

- Begin by filling in your name and the date in the designated fields at the top of the form. Ensure that the name provided matches your legal identification.

- Indicate whether you are applying as an individual or in conjunction with a co-applicant by selecting the appropriate option under the Joint/Individual Intent section.

- Complete the Credit Insurance Disclosure section. Understand that you are not required to purchase insurance products as a condition for loan approval and acknowledge this by signing the form.

- If applicable, provide information related to your military status in the Covered Borrower Identification Statement section. Initial next to the statement that accurately describes your situation.

- If you have a co-applicant, ensure they also fill in their name, date, and provide their signature where required.

- Review the entire form for accuracy and completeness. It is essential to ensure that all information provided is truthful, as false statements may carry legal consequences.

- Once satisfied with the form, save your changes, and you may then choose to download, print, or share the completed Credit Application Disclosures as needed.

Complete your Credit Application Disclosures online today to facilitate your loan processing.

A credit disclosure notice is an official document that notifies consumers of their credit terms and obligations. This notice is often sent when a consumer applies for credit or receives changes in their credit terms. Knowing what to look for in these Credit Application Disclosures can aid in better financial decision-making.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.