Get Sole Proprietorship Resolution Of Authority

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sole Proprietorship Resolution Of Authority online

Filling out the Sole Proprietorship Resolution Of Authority online is essential for the management and authorization of your business operations. This guide provides a user-friendly overview, detailing each section of the form to ensure clarity and ease of completion.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

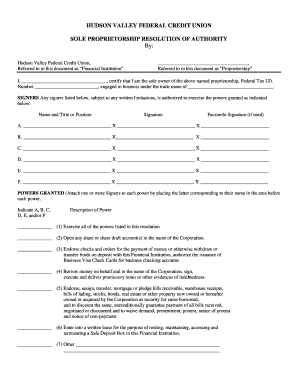

- In the first section, enter the full name of your proprietorship. You will also need to provide your Federal Tax Identification Number. Ensure that the trade name used is accurate and reflects your business operations.

- Next, you will certify your status as the sole owner of the proprietorship by signing the document in the provided space. This confirms not only your ownership but also your authority to authorize actions on behalf of your business.

- Proceed to the ‘Signers’ section. Here, list the names and titles of any individuals authorized to act on behalf of your proprietorship. For each signer, include their signature and, if applicable, a facsimile signature. Be mindful of any written limitations you may wish to impose on their authority.

- In the ‘Powers Granted’ section, you have to assign specific powers to each signer. Indicate which signers are associated with each power by placing their corresponding letters (A, B, C, etc.) next to the relevant powers.

- For any limitations on powers, clearly outline these in the designated section. This ensures transparency and prevents misunderstandings regarding what each signer can or cannot do.

- Certification of authority is the next step. You will need to affirm that your proprietorship has the necessary power to adopt the resolutions and grant powers as outlined. Ensure to complete this portion with the proper date and your name.

- If required, provide notarization by having a notary public sign the document. This adds a layer of authenticity and can be crucial for certain legal transactions.

- Finally, review the entire document for completeness and accuracy. Once satisfied, you can save changes, download the document, print it for your records, or share it as necessary.

Complete your Sole Proprietorship Resolution Of Authority online to effectively manage your business operations.

No, a sole proprietorship is not a corporation. It is a business structure where one individual owns and operates the business without forming a separate legal entity. Unlike corporations, a sole proprietor bears unlimited personal liability, meaning business debts can impact personal assets. Understanding this difference is important when considering the implications of a Sole Proprietorship Resolution Of Authority.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.