Loading

Get Business Vehicle Loan Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BUSINESS VEHICLE LOAN APPLICATION online

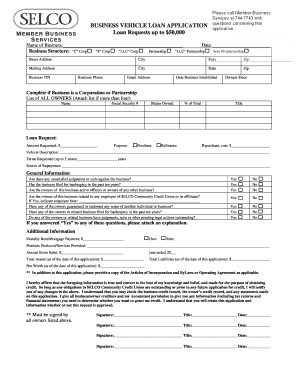

Filling out the Business Vehicle Loan Application online is a straightforward process that allows you to request funding for a business vehicle. This guide provides a clear, step-by-step approach to help you complete the application effectively.

Follow the steps to fill out the application with ease.

- Use the ‘Get Form’ button to access the Business Vehicle Loan Application form and open it for editing.

- Begin by entering the name of your business in the designated field, followed by the date of application.

- Select the business structure from the provided options, such as ‘S’ Corp, ‘LLC’, Partnership, or Sole Proprietorship.

- Fill in the street address, city, state, and zip code for your business location, as well as your mailing address if it differs.

- Provide your Business TIN (Tax Identification Number), business phone number, and email address to facilitate communication.

- Indicate the date your business was established and the ownership duration.

- For corporations or partnerships, list all owners. Attach a supplementary list if there are more than four owners, including their names, Social Security numbers, shares owned, percentage of total, and titles.

- State the loan amount you are requesting, the purpose (e.g., purchase or refinance), and if it's a purchase, include the cost of the vehicle.

- Describe the vehicle you intend to purchase, including relevant details.

- Indicate the terms you are requesting for the loan, which can be up to five years.

- Identify the source of repayment for the loan.

- Answer the general information questions regarding judgments, bankruptcy filings, relationships with employees of the credit union, and any outstanding legal actions.

- If any questions were answered with 'Yes', provide a detailed explanation as needed.

- Complete the additional information fields, including monthly rent/mortgage payment, ownership status, products or services provided, annual gross sales, total assets, total liabilities, and net worth.

- Attach any required documents, such as the Articles of Incorporation and Bylaws or Operating Agreement, as applicable.

- Affirm the accuracy of the information provided by signing and dating the form. Ensure all owners listed sign as well.

- Finally, save your changes, then download, print, or share the completed form as needed.

Start your application for a business vehicle loan online today!

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.