Get Truth-in-savings Disclosure

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Truth-in-Savings Disclosure online

The Truth-in-Savings Disclosure is an essential document that outlines the terms, rates, and fees associated with your account. Understanding how to properly fill out this form online ensures that you have all the information needed for effective account management.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to retrieve the Truth-in-Savings Disclosure and open it in your editing interface.

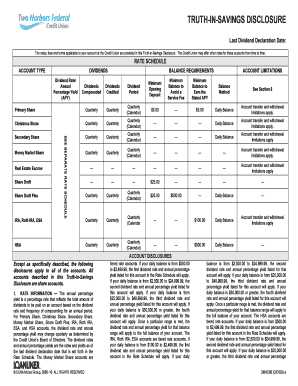

- Review the last dividend declaration date to understand the timeframe of the rates, fees, and terms provided in the document.

- Complete the rate schedule section by selecting your account type. Pay careful attention to the dividend rates, balance requirements, and any account limitations.

- Include the minimum opening deposit amount for your account type, ensuring it aligns with the requirements outlined in the rate schedule.

- Familiarize yourself with the annual percentage yield (APY) and the nature of dividends, as these will influence your account earnings.

- Fill out the accrual of dividends section, which specifies when your dividends will start accruing after deposits.

- Review the account limitations, as this information is crucial to understanding how many withdrawals or transfers you can make in a month.

- Carefully read the fees for overdrawing accounts to ensure you are aware of any potential costs associated with insufficient funds.

- Once all sections are filled out accurately, save your changes. You may then choose to download, print, or share the completed form.

Begin your Truth-in-Savings Disclosure process online today.

inSavings Disclosure must contain specific information, including the annual percentage yield, interest rate, and any applicable fees. It also details the terms for withdrawing funds and maintaining the account. By clearly outlining these elements, the disclosure promotes informed decisionmaking for account holders. This requirement supports transparency throughout your banking experience, maximally benefiting your financial choices.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.