Get Application For Credit

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the APPLICATION FOR CREDIT online

Completing the APPLICATION FOR CREDIT online can be a straightforward process if you follow the instructions carefully. This guide provides a comprehensive overview of the essential steps needed to ensure your application is filled out correctly.

Follow the steps to successfully complete your APPLICATION FOR CREDIT.

- Click the ‘Get Form’ button to obtain the form and open it in your editor. This will allow you to start filling out the application online.

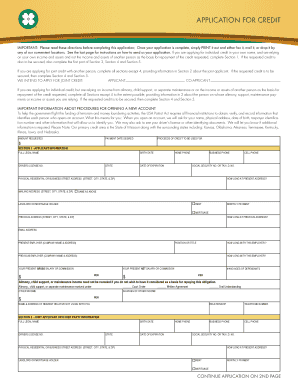

- Begin with Section 1, which requires your applicant information. Fill in your full legal name, birth date, driver's license number, and state. Additionally, provide your home phone, business phone, social security number or tax identification number, and the expiration date of your driver's license.

- Proceed to fill in your physical residential or business address including street, city, state, and ZIP. If applicable, include your mailing address and indicate if it's the same as your residential address.

- Complete the landlord or mortgage holder information, along with how long you have lived at your current address.

- Provide information about your present employer, including the company name and address, your position or title, and how long you have been employed there.

- Next, enter your gross salary or commission, as well as any other sources of income. Indicate if any additional income sources, like alimony or child support, should be considered.

- If you are applying for joint credit, move on to Section 2. Here, include the joint applicant or other party's information, similar to what you provided in Section 1.

- For Section 3, specify your marital status. If the credit is secured, proceed to Section 4 and describe the property being offered as security.

- In Section 5, input the insurance provider information if the credit is to be secured by an insurance product.

- Finally, review all the provided information for accuracy. Once completed, you can save changes or download the application for printing or sharing.

Complete your APPLICATION FOR CREDIT online now and take the first step towards securing your credit needs.

A credit application is a straightforward document where you request credit from a financial institution or vendor. It typically includes personal and financial information that helps assess your creditworthiness. By providing this information, you allow lenders to review your financial background, enabling better decision-making regarding your credit request. Completing a credit application is the first step toward obtaining the financing you need.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.