Loading

Get Schedule Of Previous Or Existing Sba Loans

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule Of Previous Or Existing SBA Loans online

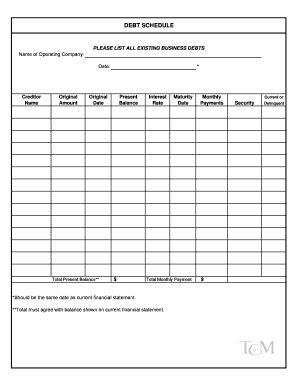

The Schedule Of Previous Or Existing SBA Loans is an essential form for documenting existing business debts. This guide provides a clear, step-by-step approach to assist you in completing the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling in the 'Name of Operating Company' field with the official name of your business. This is essential for proper identification.

- In the 'Date' field, enter the date on which you are completing the form. Ensure this date aligns with the date noted on your current financial statement.

- List each existing business debt under the 'Creditor Name' section. Make sure to include the full names of all creditors associated with your debts.

- In the 'Original Amount' field, enter the initial loan amount borrowed from each creditor. This value should reflect the original loan agreement.

- Provide the 'Original Date' for each loan to help track when the borrowing took place. This date should correspond with the date stated in the loan documentation.

- The 'Total Present Balance' field should reflect the current total amount owed on each loan, which should match the amount on your current financial statement.

- Next, input the 'Interest Rate' applicable to each loan, which may be listed in your loan agreement or payment plan.

- For the 'Maturity Date,' enter the date when each loan is due to be fully paid off, according to your loan terms.

- Fill in the 'Total Monthly Payment' to inform how much you are obligated to pay each month toward each loan.

- In 'Current or Delinquent,' indicate if the payments are up to date or if you have missed any payments.

- Finally, review all entered information for accuracy and completeness. After confirming everything is correct, save your changes, then you can download, print, or share the completed form as needed.

Complete your documents online today for a seamless experience.

In retail, SBA often stands for Supply-Based Assessment. This approach evaluates the efficiency and effectiveness of supply chain management, ensuring that businesses optimize their inventory and reduce costs. By understanding this concept, you can refine your business strategies, which can also influence the performance of your Schedule Of Previous Or Existing SBA Loans.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.