Loading

Get Consumer Loan Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Consumer Loan Application online

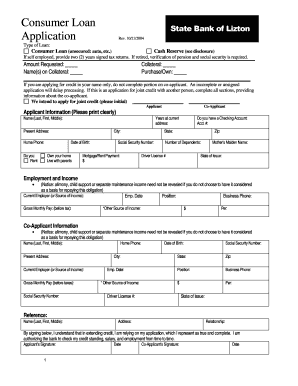

Filling out the Consumer Loan Application online is an important step toward securing the financing you need. This guide will help you navigate the form with ease, ensuring that you provide all necessary information accurately.

Follow the steps to complete your application successfully.

- Click the ‘Get Form’ button to access the Consumer Loan Application and open it for completion.

- Begin by selecting the type of loan you are applying for, such as a consumer loan or cash reserve. Be sure to read any relevant disclosures regarding each option.

- In the section titled 'Amount Requested', enter the total amount of money you wish to borrow. If applicable, indicate any collateral that you may be offering.

- Provide your name and contact information in the 'Applicant Information' section. Make sure to print clearly to avoid processing delays.

- Indicate your housing status by choosing whether you rent, own your home, or live with others. Include your years at the current address.

- Enter your social security number, driver's license number, and verification of employment or income details, including gross monthly pay and other income sources.

- If you have a co-applicant, fill in their details in the corresponding section—ensure all fields are accurately completed to avoid delays.

- In the reference section, provide a contact for your personal reference, including their relationship to you.

- Upon completing the form, review all entries for accuracy. Ensure that all required fields are filled out to prevent complications in processing.

- Finally, if applicable, sign the application. You may now choose to save your changes, download, print, or share the completed form.

Start filling out your Consumer Loan Application online today!

Consumer loans can carry risks, such as high-interest rates and the potential for debt accumulation. If you fail to make payments, you could face penalties or even damage your credit score. Understanding the terms outlined in your Consumer Loan Application is crucial to mitigate these risks.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.