Loading

Get Account Reconcilement Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Account Reconcilement Form online

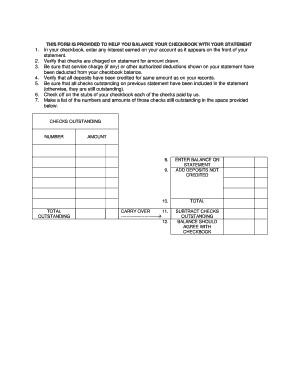

The Account Reconcilement Form is designed to assist users in balancing their checkbook with their bank statement. This guide provides a clear, step-by-step method for filling out the form online, ensuring accuracy and ease throughout the process.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering any interest earned on your account as noted on the front of your bank statement into your checkbook.

- Verify that all checks that have cleared are accurately reflected on your statement for the amounts drawn.

- Ensure that any service charges or other authorized deductions displayed on your statement have been deducted from your checkbook balance.

- Confirm that all deposits have been credited in accordance with your own records.

- Check that all outstanding checks from the previous statement are included in the current statement; otherwise, they remain outstanding.

- Mark off each check that has been paid on the stubs of your checkbook.

- Make a list of the numbers and amounts of any outstanding checks using the designated space provided in the form.

- Calculate the total outstanding checks to ensure accuracy.

- Enter your balance as stated, add any deposits not yet credited, then subtract the total outstanding checks. The final balance should match your checkbook.

- Review all entered data for accuracy before completing the process.

- Once satisfied with the information, save your changes, download the form, print it, or share as needed.

Complete your Account Reconcilement Form online today for a seamless financial review.

You can get a reconciliation statement by requesting it from your bank or financial institution directly. Alternatively, if you're managing your finances online, look for the reports section in your accounting software. Using the Account Reconcilement Form can enhance the process by clearly listing the needed information for a comprehensive reconciliation statement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.