Loading

Get Indirect Loan Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the INDIRECT LOAN APPLICATION online

Completing the indirect loan application online can be a straightforward process if you understand the required information. This guide will help you navigate each section of the application effectively, ensuring you provide the necessary details accurately.

Follow the steps to complete your application seamlessly

- Press the ‘Get Form’ button to access the application form in your preferred format.

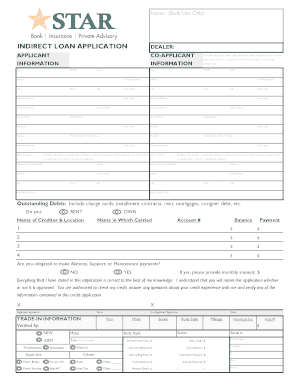

- Begin with the dealer section. Enter the name of the dealer providing the loan.

- Fill in applicant information, including your first, middle, and last name, address, social security number, home phone, date of birth, employer details, and monthly salary. Be sure to provide accurate and current information.

- Complete the co-applicant information, if applicable. This includes the co-applicant's names, contact details, and employment information.

- In the outstanding debts section, list any existing debts including creditor names, balances, and monthly payments. This can include mortgage, rent, credit cards, and loans.

- Indicate whether you own or rent your residence, and if applicable, report any alimony, child support, or maintenance commitments.

- Provide details for nearest relatives which can include their names, phone numbers, addresses, and relationships to you.

- Finally, review your application for accuracy. Ensure all information is correct and sign the application, confirming your knowledge of the details provided.

- Once you have filled in all required fields, you can save your changes, download, print, or share the form as needed.

Begin your indirect loan application online now and take the next step towards securing your loan.

The main difference lies in the involvement of intermediaries. Direct financing means you borrow directly from a lender, whereas indirect financing involves a third party that connects you with lenders. This distinction is crucial when completing an INDIRECT LOAN APPLICATION, as it can affect the terms and convenience of your borrowing experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.