Loading

Get Balancing Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Balancing Form online

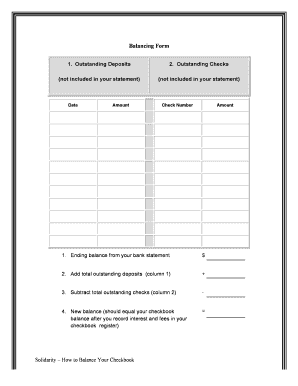

The Balancing Form is an essential document for reconciling your bank statement with your checkbook. This guide will provide you with clear, step-by-step instructions to help you complete the form online effectively.

Follow the steps to fill out the Balancing Form accurately.

- Press the ‘Get Form’ button to access the Balancing Form and open it in your editing interface.

- Begin with the first section labeled 'Outstanding Deposits'. Enter the date of each outstanding deposit that is not included in your bank statement. In the corresponding 'Amount' field, input the total amount of each deposit.

- Move to the next section titled 'Outstanding Checks'. Similar to the previous section, enter the date for each outstanding check that is not reflected in your bank statement. Record the check number and the amount for each entry.

- At the bottom of the form, locate the section for calculating your new balance. Input the ending balance from your bank statement in the designated field. Then, add the total of your outstanding deposits from column 1.

- Next, subtract the total of your outstanding checks from column 2. This calculation will yield your new balance, which should correspond with your checkbook balance after considering any interest and fees recorded in your checkbook register.

- Once you have completed the form and reviewed all entries for accuracy, you can save your changes. You also have the option to download, print, or share the form as needed.

Start filling out your Balancing Form online today!

Related links form

Performing balance sheet format involves structuring the document into the standard sections: assets, liabilities, and equity. Each section should be clearly labeled, with proper delineation between current and non-current items. Adopting a balancing form ensures that your balance sheet remains clear and intuitive for users.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.