Loading

Get Imcu Business Loan Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IMCU business loan application online

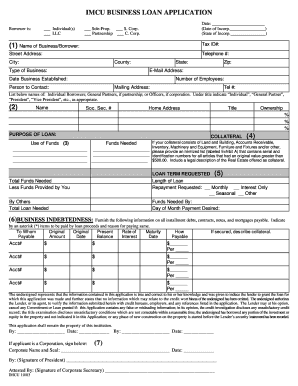

Filling out the IMCU business loan application online can be a straightforward process when approached step-by-step. This guide will provide you with clear instructions for each section of the form, ensuring you present your business information accurately.

Follow the steps to complete the application with ease.

- Press the 'Get Form' button to access the IMCU business loan application form and open it in your preferred format.

- Begin by entering your borrower's information. Indicate whether you are applying as an individual, LLC, sole proprietorship, S. Corporation, partnership, or C. Corporation. Provide the date and the state of incorporation if applicable.

- Fill in the name of the business or borrower, along with the tax identification number and physical address. Include your contact information, such as telephone number and email address.

- Detail the business's establishment date, number of employees, and provide the name and contact details of the person responsible for the application.

- List all individuals involved in the application. Include their names, social security numbers, home addresses, titles, and ownership percentages. Mark titles appropriately with 'Individual', 'General Partner', 'President', or similar.

- State the purpose of the loan by clearly outlining how the funds will be utilized. Use concise descriptions to convey the intended uses.

- If collateral is required, specify the assets that will be used. If collateral includes land and buildings or other items, provide a detailed list (Exhibit A) along with any essential serial or identification numbers.

- Complete the loan term requested section by indicating the desired length of the loan and your preferred repayment method, such as monthly payments or interest-only payments.

- Detail your business's existing debts by listing all installment debts, contracts, notes, and mortgages payable. Include original amounts, present balances, interest rates, maturity dates, and descriptions of collateral if applicable.

- Review all provided information for accuracy. Ensure that all sections are completed and that your application represents your business truthfully.

- Finalize your application by providing necessary signatures and dates in the designated areas. If representing a corporation, include the corporate name and seal, along with signatures from the relevant officers.

- Save your changes to the application. You may then download, print, or share the completed form as needed.

Get started today by completing your business loan application online!

Yes, you can use your EIN instead of your SSN for a business loan application. This is particularly useful for business entities since it separates personal and business financial matters. The IMCU BUSINESS LOAN APPLICATION enables you to take this step confidently, emphasizing your business identity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.