Get Mortgage Electronic Access Authorization

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mortgage Electronic Access Authorization online

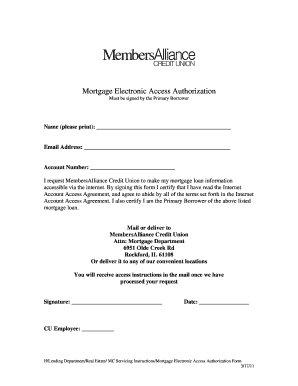

The Mortgage Electronic Access Authorization is a key document that allows users to access their mortgage loan information online. This guide will provide you with easy-to-follow steps to complete this form accurately.

Follow the steps to complete the authorization form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the 'Name' field, please print your name clearly as it appears on your mortgage documents.

- Enter your email address in the 'Email Address' field. Ensure that you use a valid email to receive access instructions.

- Provide your account number in the designated 'Account Number' field. This number is essential for linking your mortgage loan information.

- Read the Internet Account Access Agreement carefully. This document outlines the terms of accessing your loan information online.

- After reviewing the agreement, confirm your understanding by signing your name in the 'Signature' field.

- Fill in the date of your signature in the 'Date' field.

- If applicable, a CU employee should complete the 'CU Employee' field at the bottom of the form.

- Once all fields are completed, you can save changes to your form, download a copy for your records, print the document, or share it as needed.

Complete your Mortgage Electronic Access Authorization form online today to gain convenient access to your mortgage information.

Mortgage electronic registration systems, like MERS, are primarily owned by the institution that operates them, namely MERSCORP Holdings. The aim of this structure is to consolidate and streamline mortgage registration across the country. This consolidation simplifies the tracking of mortgage ownership and servicing rights. Understanding ownership in these registration systems is crucial for effective Mortgage Electronic Access Authorization.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.