Loading

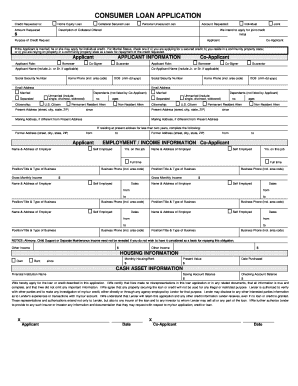

Get Consumer Loan Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CONSUMER LOAN APPLICATION online

Navigating the online consumer loan application process can be straightforward with the right guidance. This comprehensive guide is designed to help you complete the CONSUMER LOAN APPLICATION effectively and accurately.

Follow the steps to fill out the consumer loan application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Start by selecting the type of credit requested. You can choose between a home equity loan, collateral secured loan, or personal unsecured loan.

- Enter the amount you are requesting in the designated field.

- Indicate the type of account you are applying for, choosing either individual or joint credit. If applying jointly, confirm your intention by selecting the checkbox.

- Provide a description of any collateral you are offering, if applicable, and state the purpose of the credit request.

- Complete the applicant information section, including names, social security numbers, and contact details such as phone numbers and email addresses.

- Indicate the marital status, dependents, and citizenship type for both the applicant and co-applicant, if applicable.

- Fill out the employment and income information, including the name and address of employers, job titles, gross monthly income, and years at current jobs.

- Outline housing information, specifying whether you own or rent, the current value of your home, and your monthly housing costs.

- List your assets and liabilities, including bank account balances, loans, and other financial obligations.

- Review the certification statement confirming that all provided information is true and complete, and ensure you electronically sign and date the application.

- After completing the form, save your changes, and choose to download, print, or share the form as needed.

Start your journey to secure the funding you need by completing your consumer loan application online today.

Individuals looking to finance personal purchases, such as home improvements, medical expenses, or unexpected costs, typically take out consumer loans. These loans can also benefit those consolidating debt or looking for lower interest rates. Before completing your consumer loan application, assess your needs and evaluate how this loan type fits into your financial strategy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.