Loading

Get Certificate Relating To Form W-8ben

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CERTIFICATE RELATING TO FORM W-8BEN online

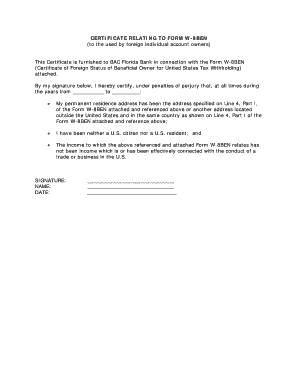

This guide provides a comprehensive overview of how to fill out the Certificate Relating to Form W-8BEN online. This certificate is essential for foreign individuals to certify their foreign status to BAC Florida Bank for tax-related purposes.

Follow the steps to complete the form accurately online.

- Click ‘Get Form’ button to obtain the form and access it in your preferred editor.

- In Line 4 of Part I, enter your permanent residence address. Ensure this address is outside the United States and matches the country specified in this section of the Form W-8BEN.

- In the certification section, confirm that throughout the years specified, you have not been a U.S. citizen or resident. You will mark this box to confirm your understanding.

- Indicate that the income related to the Form W-8BEN is not effectively connected to any trade or business conducted within the United States. This needs to be clear to meet the requirements.

- Provide your signature, name, and date at the bottom of the form. Ensure that your signature aligns with the name you provided to avoid any discrepancies.

- After completing all required fields, review the form for accuracy. Once confirmed, save your changes, and choose to download, print, or share the completed document as necessary.

Complete your certificate online today to ensure compliance and facilitate your banking needs.

Related links form

If you do not complete a W-8BEN form, your U.S. income may be subject to higher withholding taxes, which could significantly affect your earnings. Without this certificate relating to Form W-8BEN, you might miss out on beneficial tax rates or treaty exemptions. Therefore, it is vital to fill out and submit this form to maintain financial efficiency and compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.