Loading

Get It-140 Nrc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT-140 NRC online

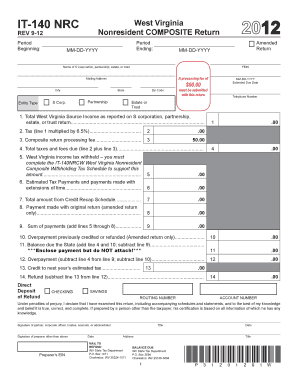

Filling out the IT-140 NRC online is an important step for nonresident individuals who need to file a composite income tax return in West Virginia. This guide provides clear and detailed instructions to help you navigate and complete the form accurately.

Follow the steps to complete your IT-140 NRC online.

- Click ‘Get Form’ button to obtain the IT-140 NRC and open it in your preferred editing tool.

- Enter the name of the pass-through entity (S corporation, partnership, estate, or trust) in the designated field.

- Provide the Federal Employer Identification Number (FEIN) of the entity.

- Indicate the mailing address, including city, state, and zip code, where correspondence should be sent.

- Fill in the period beginning and period ending dates using the MM-DD-YYYY format.

- If you are submitting an amended return, specify the date of the original return that is being amended.

- Complete the line for total West Virginia source income as reported on the appropriate entity return.

- Calculate the tax owed by multiplying the total West Virginia source income by 6.5% and enter this amount in the tax field.

- Include the composite return processing fee of $50.00 in the appropriate line.

- Calculate the total taxes and fees due by adding the tax and processing fee.

- Enter any West Virginia income tax withheld and provide details as required.

- Total any estimated tax payments or payments made with extensions of time to be included.

- Sum all payments made previously and write the total in the designated field.

- If applicable, calculate any overpayment and refund due, ensuring to follow the outlined calculations.

- Choose a refund method by indicating 'Direct Deposit' or receiving a check and provide the necessary banking information if relevant.

- Sign and date the form. If prepared by someone other than the taxpayer, those details should also be included.

- Finally, review all completed entries for accuracy and completeness before saving your changes, downloading, printing, or sharing the form.

Complete your IT-140 NRC online today for a seamless filing experience.

Yes, West Virginia allows for a composite tax return, which simplifies reporting for certain groups of nonresidents. This type of return aggregates the income of multiple nonresidents, allowing a single tax return to cover their tax obligations. Using the IT-140 NRC, you can benefit from this simplified process. If you are part of a business or partnership, consider utilizing US Legal Forms to streamline your filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.