Loading

Get Hr P-pdv Form 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HR P-PDV Form online

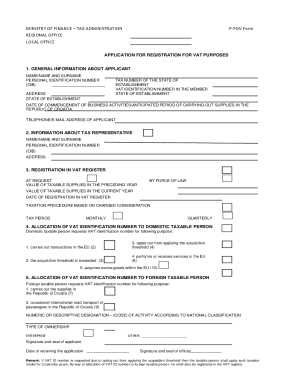

The HR P-PDV Form is essential for individuals and businesses applying for VAT registration. This guide provides step-by-step instructions on how to seamlessly complete the form online, ensuring that you provide all necessary information accurately.

Follow the steps to successfully complete the HR P-PDV Form online.

- Press the ‘Get Form’ button to access the HR P-PDV Form and open it in the editor.

- Fill in the general information about the applicant. Include your name, personal identification number, address, state of establishment, tax number of the state of establishment, VAT identification number in the member state of establishment, date of commencement of business activities, and your contact information, including phone number and email address.

- Provide information about your tax representative by entering their name, personal identification number, and address.

- In the section for registration in the VAT register, indicate whether the registration is at request or by force of law. Fill in the value of taxable supplies for the preceding and current year and select the taxation procedure based on charged consideration and tax period preference, whether monthly or quarterly.

- Specify the purpose for which you are requesting the VAT identification number as a domestic taxable person: carrying out transactions in the EU, exceeding the acquisition threshold, opting out from applying the acquisition threshold, or providing services in the EU.

- As a foreign taxable person, indicate the purpose of your VAT identification number request such as carrying out supplies in Croatia or occasional international road transport of passengers.

- Choose the numeric or descriptive designation of your activity according to the national classification and select the type of ownership, either enterprise or other specified types.

- Finally, ensure you complete the signature and seal of the applicant section, and date your application. After reviewing all entries for accuracy, you can save changes, download, print, or share the form.

Complete your HR P-PDV Form online today for a smooth VAT registration process.

The tourist tax in Croatia varies based on factors such as the location and type of accommodation. This tax supports local infrastructure and tourism initiatives. When managing your tourist accommodations, the HR P-PDV Form can aid in tracking and reporting any applicable taxes accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.