Get Fannie Mae Purchase Addendum 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fannie Mae Purchase Addendum online

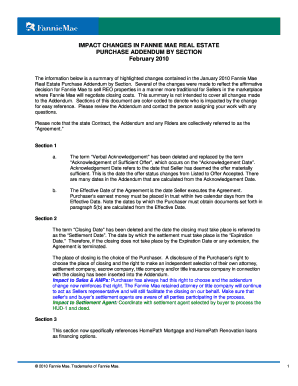

Completing the Fannie Mae Purchase Addendum online can be straightforward with the right guidance. This document serves as an essential part of the real estate transaction process, especially when purchasing REO properties. Follow this guide to navigate the addendum effectively.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the document editor.

- Review the first section of the addendum, which discusses the Acknowledgement Date. This is when the seller has considered the offer sufficient. Ensure you take note of this date, as many other deadlines are calculated from it.

- In the next section, update the Settlement Date, which replaces any prior references to the Closing Date. Ensure you understand that if the settlement does not occur by the Expiration Date, the Agreement will be terminated.

- Next, note the financing options listed for HomePath Mortgage and HomePath Renovation loans in Section 3, and ensure you select appropriate options.

- In Section 5, remember that the purchaser can terminate the Agreement if they are unsatisfied with repairs, as they need not pay for de-winterization.

- Continue to Section 8 where you indicate if tenants occupy the property. Ensure you understand and document any lease assignments occurring at closing.

- Before finalizing, review Section 34 regarding electronic signatures. An electronic signature holds the same validity as a handwritten one in the context of the Agreement.

- After filling in the necessary information, review the entire document for accuracy. Once satisfied, you can save your changes, download, print, or share the finalized form.

Start filling out your Fannie Mae Purchase Addendum online today!

Freddie Mac has different but similar guidelines for accessory dwelling units (ADUs) compared to Fannie Mae. Generally, the ADU must also meet local zoning and building regulations, and must have all necessary facilities to be self-sufficient. While navigating these guidelines, consider the distinction between Fannie Mae and Freddie Mac by reviewing all specific requirements, making the overall process clearer with tools like US Legal Forms when drafting your documents.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.