Get Irs 1122 2003-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1122 online

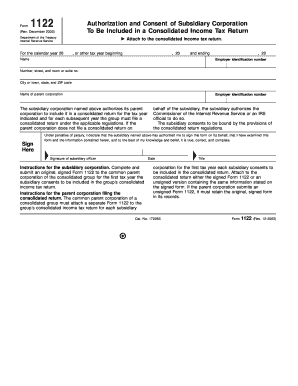

Filling out the IRS Form 1122 is an essential step for subsidiary corporations that wish to be included in a consolidated income tax return. This guide will walk you through the process of completing the form online, ensuring that you have a clear understanding of each section.

Follow the steps to fill out the IRS Form 1122 accurately.

- Press the ‘Get Form’ button to access the form and open it in your editor.

- In the first section, enter the name of the subsidiary corporation as it appears on official documents.

- Provide the employer identification number (EIN) for the subsidiary corporation.

- Fill in the address details, including number, street, room or suite number, city or town, state, and ZIP code.

- Next, indicate the name and employer identification number of the parent corporation.

- Authorizes the parent corporation to file a consolidated return by checking the appropriate box.

- Sign the form in the designated area indicating the subsidiary officer's signature.

- Provide the date of signature in the specified format.

- Include the title of the person signing the form to confirm their authority.

- Review all entered information for accuracy before proceeding.

- Once completed, you can save changes, download, print, or share the form as necessary.

Complete the IRS Form 1122 online to ensure your subsidiary corporation is included in the consolidated income tax return.

Individuals, partnerships, corporations, and trusts that earn income above certain thresholds are required to file a return of income. In particular, based on IRS 1122 guidelines, compliance with tax obligations is crucial to avoid penalties. Familiarity with income reporting requirements can help ensure that you're addressing your tax responsibilities appropriately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.