Get Form For Reporting Changes

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form For Reporting Changes online

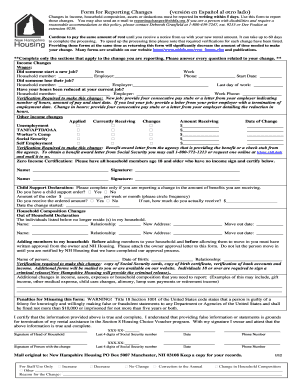

The Form For Reporting Changes is essential for notifying relevant authorities about any changes in income, household composition, assets, or deductions. Completing this form accurately and promptly helps ensure that your rental assistance remains properly adjusted.

Follow the steps to fill out the Form For Reporting Changes online.

- Press the ‘Get Form’ button to obtain the document and open it in your preferred editor.

- Read the instructions carefully before proceeding. The form's introduction highlights the importance of reporting changes within five days and details further contact information for assistance.

- Complete only the sections that apply to your specific changes. Ensure that every question related to your reported change is answered accurately.

- For income changes, detail any new jobs, job losses, or reduced hours, including the necessary verification documents mentioned in the form.

- Fill out the section regarding other income changes, including unemployment benefits and child support, ensuring you indicate the relevant amounts and dates of change.

- If applicable, certify zero income for all household members over the age of 18 who have no income. Each member must sign to validate their zero income status.

- If you are reporting changes in household composition, complete the out-of-household declaration or the section for adding new household members, ensuring to include the necessary verification and written approval as stipulated.

- Review the entire form for accuracy and completeness. Ensure that all required signatures are obtained to prevent processing delays.

- Once all sections are completed, save your changes, download a copy of the form, and if desired, print or share it as needed.

Complete your Form For Reporting Changes online today to ensure that your assistance is properly adjusted.

Related links form

Filing a revised return can be done by submitting the accurate version of your original return along with any corrections needed. You typically use Form 1040-X for this process, and ensure all changes are clearly noted. For efficient guidance, consider using resources from USLegalForms, which offer expert assistance in ensuring your revised return meets all necessary standards. Submit your revised return promptly to avoid delays.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.