Loading

Get Nebraska Schedule Ii

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NEBRASKA SCHEDULE II online

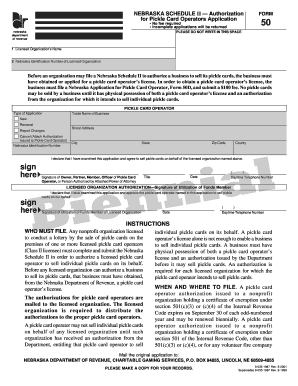

The Nebraska Schedule II is a crucial form for nonprofit organizations looking to authorize businesses to sell pickle cards on their behalf. This guide will provide you with clear, step-by-step instructions to complete the form online, ensuring a smooth process.

Follow the steps to successfully fill out the Nebraska Schedule II online.

- Press the ‘Get Form’ button to obtain and access the Nebraska Schedule II form in an online editor.

- In the first section, enter the licensed organization’s full name and the Nebraska Identification Number assigned to the organization.

- Select the type of application you are submitting: new, renewal, or report changes. Additionally, fill in the trade name of the business and their street address.

- Provide the city, state, zip code, and county for the business. Make sure all information is accurate and up to date.

- By signing in the designated area, the owner, partner, member, officer of the pickle card operator, or an authorized person must affirm their agreement to the terms of the application.

- Include the date of the signature and provide a daytime telephone number where the signer can be reached for further verification.

- In the 'Licensed Organization Authorization' section, a utilization of funds member must also sign, date, and provide their daytime telephone number.

- Once all sections are filled out, review the information for accuracy. After ensuring that everything is correct, save the changes, download a copy for your records, and print the completed form.

- Finally, mail the signed original application to the Nebraska Department of Revenue, Charitable Gaming Services, and keep a copy for your records.

Start filling out your Nebraska Schedule II online today for a seamless application process.

Related links form

To obtain the Nebraska property tax credit, you must meet specific eligibility requirements and apply through your county assessor’s office. The application process often requires documentation of income and property ownership. Once approved, you will receive a reduction on your property tax bill. USLegalForms can assist you in this process by providing the necessary forms and information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.