Loading

Get 504e

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 504E online

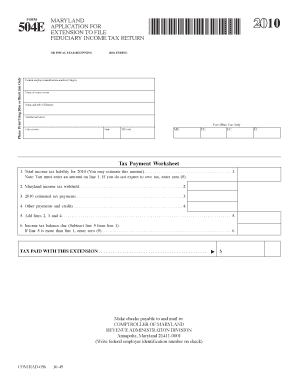

Filling out the 504E online can streamline the process of applying for an extension to file your fiduciary income tax return in Maryland. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the 504E form online.

- Press the ‘Get Form’ button to retrieve the form and launch it in your preferred browser.

- Enter the federal employer identification number, ensuring it consists of nine digits.

- Fill in the name of the estate or trust accurately as it appears in your records.

- Provide the name and title of the fiduciary responsible for this application.

- Input the complete address, including number, street, city or town, state, and ZIP code.

- On the tax payment worksheet, begin by estimating your total income tax liability for the year and enter that amount in line 1. If you expect no tax to be owed, input zero (0).

- Enter the amount of Maryland income tax withheld on line 2.

- Record any estimated tax payments made on line 3.

- Document any other payments or credits applicable to your situation on line 4.

- Add the amounts from lines 2, 3, and 4 together and write the total on line 5.

- Calculate your income tax balance due by subtracting the amount on line 5 from the amount on line 1. If line 5 exceeds line 1, enter zero (0) on line 6.

- Indicate any tax paid with this extension on the designated line.

- Check all information for accuracy before saving your changes or choosing to download, print, or share your completed form.

Complete your documents online to ensure a smooth filing experience.

To fill out an expenditure form, first, summarize all your expenditures for the specified period. Use 504E to input details like amounts and descriptions of each expense. This user-friendly approach makes tracking your spending straightforward and helps in maintaining accurate records.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.