Loading

Get 502up

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 502UP online

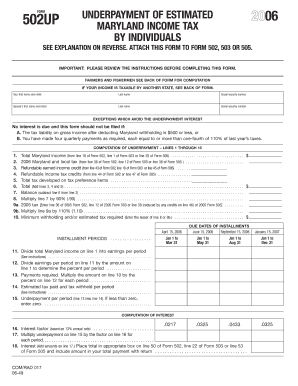

The 502UP form is essential for individuals in Maryland who need to report underpayment of estimated income tax. This guide will provide clear, step-by-step instructions on how to complete this form online effectively.

Follow the steps to fill out the 502UP form online.

- Press the 'Get Form' button to access the 502UP form and open it in your preferred online editor.

- Begin by entering your information in the designated fields, including your first name, middle initial, last name, and social security number. If applicable, also fill out your spouse's details.

- In the sections that follow, review and understand the exceptions that help avoid underpayment interest. Make sure that your tax liability or installments comply with these exceptions.

- Proceed to complete the computation section (lines 1 through 15). Start by entering your total Maryland income as specified from the related form.

- On lines 2 to 4, input the required amounts based on previous forms, and continue calculations as instructed.

- For lines 11 through 15, carefully detail your income periods and the payments required for each tax installment.

- Move to calculate interest due for any underpayment. Follow instructions from lines 16 to 18 to assess the interest rates and totals.

- Once completed, review all entries for accuracy. Ensure you have populated all necessary information and calculations.

- Finally, choose to save your changes, download the form, or print it for submission. Be sure to share any pertinent details and attach it to your related tax return forms.

Complete your documents online today for hassle-free submission.

Yes, you can file Maryland amended returns electronically, making it more convenient and efficient. E-filing allows you to make changes to your tax returns without the hassle of paper submissions. To ensure accuracy in your amendment, refer to uslegalforms, where you can find the necessary resources for a smooth filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.