Get Form 502d

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM 502D online

Filling out the FORM 502D online is a straightforward process designed to help you declare your estimated income tax efficiently. This guide provides step-by-step instructions to ensure accurate submission and compliance with Maryland tax requirements.

Follow the steps to complete FORM 502D online successfully.

- Press the ‘Get Form’ button to acquire the online version of the FORM 502D and open it in your preferred editor.

- Begin by entering your personal information, including your first name, middle initial, and last name, along with your spouse’s details if applicable. Ensure all names are correctly spelled and formatted.

- Provide your current address in the designated fields, including the street address, city or town, state, and zip code. If this is a change of address, check the appropriate box.

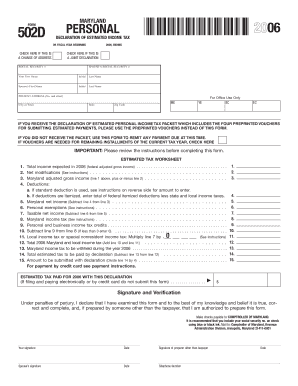

- In the 'Estimated Tax Worksheet' section, complete Line 1 by entering your total expected income for the year, which is your estimated federal adjusted gross income.

- For Line 2, calculate your net modifications as instructed to determine any additions or subtractions to your federal adjusted gross income.

- On Line 3, compute the Maryland adjusted gross income by adding or subtracting the values from Lines 1 and 2.

- Complete Lines 4a and 4b by entering your deductions, either using the standard deduction or itemized deductions based on your input.

- Follow with Lines 5 and 6 to calculate your Maryland net income and personal exemptions respectively.

- Calculate your taxable net income by subtracting Line 6 from Line 5 and enter this in Line 7.

- For Line 8, compute your Maryland income tax based on the taxable net income from Line 7 according to the specified tax rate schedule.

- Complete Lines 9, 10, and 11 to account for any credits and local taxes, leading to the total income tax due.

- On Line 12, indicate your Maryland income tax to be withheld throughout the year and calculate the estimated tax to be paid by declaration on Line 14.

- If applicable, complete the section for estimated tax paid and provide your signature along with the date. If a preparer assisted you, ensure to include their signature and contact information.

- Once all fields are filled correctly, save your changes, and choose to download, print, or share the completed form as necessary.

Start filling out your FORM 502D online today to ensure a smooth tax filing experience!

The new tax law for retirees in Maryland provides tax relief by allowing certain retirement incomes to be exempt from state taxation. This change aims to improve financial conditions for individuals during retirement. If you are a retiree, understanding how this impacts your filings, especially using the FORM 502D, is crucial to take full advantage of your benefits. Always consult up-to-date resources or uslegalforms for detailed information.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.