Loading

Get 502tp

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 502TP online

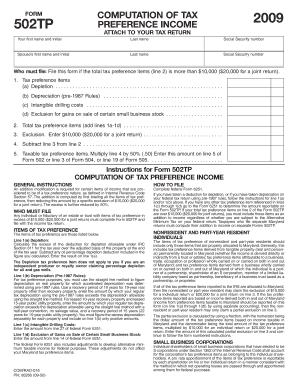

Filling out the Form 502TP online is an essential step for individuals or fiduciaries who need to report tax preference items exceeding specified thresholds. This guide will provide clear and concise instructions to ensure accurate completion of the form.

Follow the steps to complete the 502TP online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter your first name, middle initial, and last name in the designated fields. Next, provide your Social Security number.

- For the spouse’s information, fill in their first name, middle initial, last name, and Social Security number if applicable. This is necessary for joint filers.

- Go to Line 1. Here you will input tax preference items. Report each item as follows: (a) for depletion, calculate the excess of the allowable deduction under IRC Section 611 and enter it; (b) for depreciation, determine the excess of your regular tax depreciation over straight-line depreciation and enter that amount; (c) for intangible drilling costs, enter the corresponding amount from Line 27 of federal Form 6251; (d) for exclusion of gains on sale of certain small business stock, provide the amount from Line 14 of federal Form 6251.

- For Line 2, add all values from Lines 1(a) through 1(d) to find the total tax preference items.

- On Line 3, enter the exclusion, which is $10,000 for individual returns or $20,000 for joint returns.

- For Line 4, subtract the amount from Line 3 from the total on Line 2 to arrive at the remaining taxable tax preference items.

- Finally, multiply the amount from Line 4 by 50% (.50) for Line 5. This final figure should be entered on Line 5 of Form 502, Line 3 of Form 504, or Line 19 of Form 505.

- After completing all fields accurately, you can save your changes, download, print, or share the form as needed.

Complete your Form 502TP online efficiently and ensure your tax preference items are reported accurately.

Related links form

Any nonresident who earns income from Maryland sources is required to file a Maryland nonresident tax return. This includes those who receive income from jobs, rental properties, and other avenues within the state. Ensure you are well informed on your responsibilities, especially when dealing with the 502TP, to maintain compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.