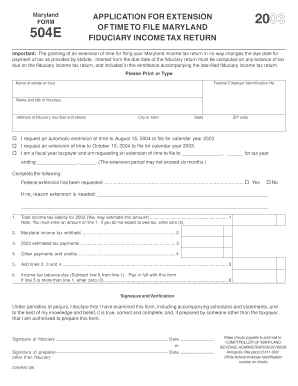

Get Application For Extension Of Time To File Maryland Fiduciary Income Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the APPLICATION FOR EXTENSION OF TIME TO FILE MARYLAND FIDUCIARY INCOME TAX RETURN online

Filing for an extension of time to submit your Maryland fiduciary income tax return can be a straightforward process. This guide will walk you through each section of the APPLICATION FOR EXTENSION OF TIME TO FILE MARYLAND FIDUCIARY INCOME TAX RETURN to ensure you complete the form correctly and submit it online with ease.

Follow the steps to fill out the application accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing platform.

- Begin by providing the name of the estate or trust in the designated field.

- Enter the Federal Employer Identification Number (EIN) for the estate or trust.

- In the next section, fill in the name and title of the fiduciary responsible for this application.

- Provide the address of the fiduciary, including street number and name, city or town, state, and ZIP code.

- Select the appropriate option to request an extension of time: 'automatic extension to August 15, 2004', 'extension to October 15, 2004', or specify a date if you are a fiscal year taxpayer.

- Indicate whether a federal extension has been requested by checking 'Yes' or 'No'. If 'No', provide a reason for the extension in the space provided.

- Next, report the total income tax liability for 2003 (you may estimate this amount). Remember to enter an amount, even if it is zero.

- Record the Maryland income tax withheld in the next section.

- Enter any 2003 estimated tax payments made.

- Input any other payments and credits that apply.

- Sum the amounts from lines 2, 3, and 4 and enter the total.

- Calculate the income tax balance due by subtracting line 5 from line 1. If line 5 exceeds line 1, enter zero.

- The fiduciary must sign and date the form, confirming the information is accurate to the best of their knowledge.

- If someone other than the fiduciary prepares the form, they must also sign and date it.

- After reviewing the completed form, you can save your changes, download it, print it, or share it as needed.

Complete your documents online to ensure timely submission and compliance.

Maryland does offer automatic extensions under specific conditions for certain taxpayers. By filing the APPLICATION FOR EXTENSION OF TIME TO FILE MARYLAND FIDUCIARY INCOME TAX RETURN, individuals and businesses can benefit from this extension, allowing them extra time to submit their paperwork. However, it remains critical to address any tax payments by the original due date to avoid incurring penalties.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.