Get Declaration Of Estimated Maryland And Local Income Tax Form 502 D

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DECLARATION OF ESTIMATED MARYLAND AND LOCAL INCOME TAX FORM 502 D online

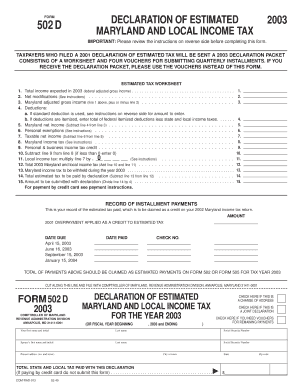

This guide provides a comprehensive walkthrough for completing the Declaration of Estimated Maryland and Local Income Tax Form 502 D online. By following these instructions, users can ensure that their tax information is accurately reported and submitted.

Follow the steps to complete your tax declaration effortlessly.

- Use the ‘Get Form’ button to access the Declaration of Estimated Maryland and Local Income Tax Form 502 D. This will open the form in an online editor where you can fill it out conveniently.

- Begin by entering your personal information, including your first name, last name, and Social Security number. For joint declarations, also fill in your partner's details.

- Indicate whether this is a change of address or if you require vouchers for remaining payments by checking the appropriate boxes.

- Calculate your total expected income for the year, as well as any net modifications, and enter these figures in the specified fields.

- Determine your Maryland adjusted gross income by adding or subtracting the net modifications from your total income. Fill in the result accordingly.

- Select either the standard deduction or itemized deductions based on your situation. Follow the instructions provided beside each option to derive the correct number.

- Next, calculate your Maryland net income by subtracting your deductions from the adjusted gross income and enter this amount.

- Fill in the amount for personal exemptions, referencing the guidelines for exemptions available for taxpayers and dependents.

- Calculate your taxable net income by subtracting personal exemptions from your Maryland net income.

- Compute your Maryland income tax based on the taxable net income and enter this amount according to the tax rate schedule provided.

- Calculate local income tax as a percentage of your taxable net income and input this value on the form.

- Add the Maryland income tax and local income tax figures to determine your total estimated tax liability for the year.

- If applicable, enter the amount of Maryland income tax that will be withheld during the year.

- Subtract the withheld amount from your total tax liability to determine the total estimated tax to be paid by declaration.

- Finally, divide the total estimated tax by four to find the amount to be submitted with your declaration. Review all information before proceeding to the final steps.

- Once completed, you can save your changes, download the form, print it for your records, or share it as needed.

Complete your Declaration of Estimated Maryland and Local Income Tax Form 502 D online today for a hassle-free filing experience.

In Maryland, the W-4 equivalent is the Maryland Employee Withholding Exemption Certificate, commonly referred to as the Maryland W4. This form allows you to declare personal exemptions and withholdings for state income tax. Completing it accurately is essential for ensuring that your withholding matches your obligations concerning the DECLARATION OF ESTIMATED MARYLAND AND LOCAL INCOME TAX FORM 502 D.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.