Loading

Get Form 500d

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM 500D online

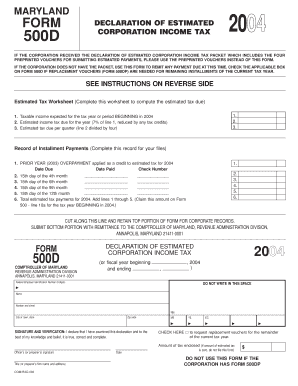

Filling out the FORM 500D is an essential task for corporations needing to declare and remit their estimated corporation income tax. This guide provides a clear, step-by-step approach to completing the form online, ensuring ease of understanding for all users, regardless of their legal expertise.

Follow the steps to complete the FORM 500D online.

- Click the ‘Get Form’ button to access the form and open it for editing.

- Enter the corporation's name exactly as listed in the Articles of Incorporation, along with any 'Trading As' name in the designated space.

- Fill in the Federal Employer Identification Number (FEIN). If you have not obtained a FEIN, indicate 'APPLIED FOR' and provide the application date.

- Specify the tax year or period by entering the beginning and ending dates as required.

- Complete the Estimated Tax Worksheet to calculate the taxable income and expected tax due for the year. Include the expected taxable income, estimated income tax due, and quarterly tax due.

- If applicable, check the box to request replacement vouchers for the remainder of the current tax year.

- Provide the amount of tax enclosed if applicable. Ensure that you do not file the form if the amount is zero.

- An authorized officer or preparer must sign and date the form, including their title or preparer’s firm name and address.

- Prepare your payment by including a check or money order made out to the Comptroller of Maryland for the full amount due.

- Save changes to your completed form, then choose to download, print, or share it as needed.

Complete your FORM 500D online today to ensure timely compliance with your corporation's estimated tax obligations.

Individuals who earn interest income below a specific threshold typically apply for the FORM 500D. This form helps them avoid tax deductions on that interest income. If you are unsure about your eligibility, consulting with a tax professional can be beneficial.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.