Get 2010 New Hampshire Qualified Allocation Plan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 New Hampshire Qualified Allocation Plan online

This guide provides detailed instructions on how to complete the 2010 New Hampshire Qualified Allocation Plan online. It is designed to assist users, regardless of their level of experience, in accurately filling out the required fields and understanding the document's components.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Familiarize yourself with the structure of the document. The form is divided into various sections including the developer fee, project details, and application requirements.

- Begin by entering your project's basic information in the designated fields such as project name, location, and developer information.

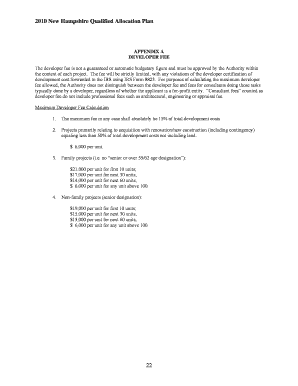

- Complete the section on developer fees by calculating the maximum developer fee allowed based on your project's total development costs and the specific guidelines outlined.

- Fill out the application threshold requirements section. Ensure you have all the exhibits and documents required, as outlined in Appendix C.

- Move to the progress phase requirements and detail any updates or relevant documents that need to be submitted within the specified timeframe.

- Complete the carryover allocation and final allocation requirements as necessary, ensuring all commitments and approvals are documented.

- Review the entire document for accuracy. Make sure all fields are filled out correctly and all requirements are met.

- Once you are satisfied with the completed form, you can save changes, download a copy, print the form, or share it as needed.

Begin filling out your application online today and ensure accurate completion of the necessary documents.

The maximum income you can earn to qualify for low-income housing in New Hampshire is usually based on the area median income and varies by household size. Typically, this limit can be up to 60% to 80% of the area median income, depending on the specific program. The 2010 New Hampshire Qualified Allocation Plan provides important guidelines to determine these limits. For exact figures relevant to your situation, consider reaching out to local housing authorities or exploring US Legal Forms for easy access to necessary forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.