Loading

Get 504up

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 504UP online

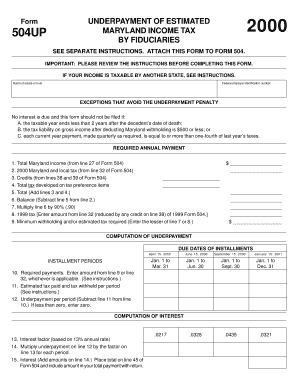

Filling out the 504UP form for underpayment of estimated Maryland income tax by fiduciaries can be straightforward with the right guidance. This guide provides clear, step-by-step instructions to help you accurately complete the form online.

Follow the steps to complete the 504UP form effectively.

- Press the ‘Get Form’ button to access the online form and open it in your preferred editor.

- Begin by entering the name of the estate or trust in the designated field and include the federal employer identification number.

- Review the exceptions to avoid underpayment penalties and determine if any apply to you. If your circumstances meet one of the exceptions, you may not need to file this form.

- For lines 1 to 3, fill in the total Maryland income, Maryland and local tax, and credits based on your previous Form 504.

- Complete line 4 by calculating the total tax from tax preference items, adding it to the total from line 3 to get your combined total on line 5.

- Calculate the balance by subtracting the total from line 5 from the total tax from line 2 and multiply by 90% to fill in line 7.

- Refer to your 1999 Form 504, enter the applicable amount on line 8, and determine the minimum withholding and estimated tax required on line 9.

- Proceed to fill in the underpayment section, entering all amounts for required payments, estimated tax paid, and underpayment per period for each quarter.

- Calculate interest amounts for any underpayment using the relevant factors and complete the interest section. This information is crucial for the accuracy of your total payment.

- After completing all columns and allocated sections, review the entire form for accuracy before saving, downloading, printing, or sharing your completed form.

Start filling out your documents online today for a seamless experience.

Running a CSI file requires specific software that can interpret the format. However, ensuring you have the right files in order is essential. US Legal Forms provides comprehensive guidance to assist you in managing your data effectively through the 504UP feature, helping streamline any necessary processes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.