Loading

Get Wnl 409 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WNL 409 online

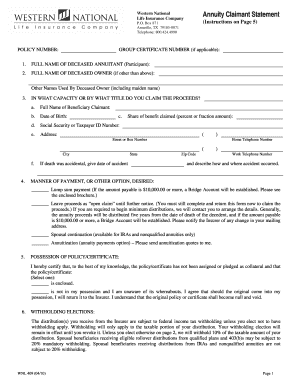

The WNL 409 form is an annuity claimant statement used for claiming the death benefits of a deceased annuitant. This guide will provide you with step-by-step instructions on how to accurately complete this form online to ensure your claim is processed efficiently.

Follow the steps to fill out the WNL 409 form online.

- Click the ‘Get Form’ button to obtain the WNL 409 form and open it in your chosen document editor.

- Enter the pertinent information, including the policy number and group certificate number (if applicable), at the top of the form.

- In section 1, provide the full name of the deceased annuitant (participant). Proceed to section 2 and input the full name of the deceased owner, if different, along with any other names they used, including their maiden name.

- In section 3, indicate your relationship to the deceased by selecting the appropriate title and entering your full name, date of birth, Social Security or taxpayer ID number, address, and your share of the benefit claimed.

- If the death was accidental, state the date of the accident and provide a brief description of how and where it occurred.

- For section 4, select your manner of payment preference from the available options: lump sum payment, open claim, spousal continuation, or annuitization.

- In section 5, certify the possession status of the policy/certificate by selecting the appropriate option and adding any necessary details.

- Navigate to section 6 to make your federal and state withholding elections. Ensure you understand the implications of your choices regarding tax obligations.

- Review all entered information for accuracy and completeness. Make sure to sign and date the form where indicated.

- Submit your completed form along with the necessary documents such as the death certificate and policy/certificate. You can save changes, download, print, or share the form as needed.

Complete your documents online to ensure a streamlined submission process.

Related links form

Section 409A primarily governs nonqualified deferred compensation plans within the United States. However, it can affect non-US taxpayers if they receive compensation from US-based companies. Understanding the implications of WNL 409 can help non-US taxpayers navigate these rules effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.