Loading

Get 502h

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 502H online

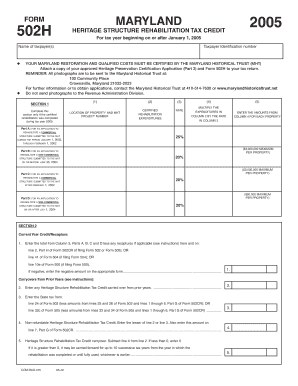

Filling out the 502H form online is essential for those seeking tax credits for the rehabilitation of certified heritage structures. This guide provides detailed instructions to help users accurately complete the form, ensuring all necessary information is included.

Follow the steps to successfully complete the 502H form.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the taxpayer(s) and their taxpayer identification number at the top of the form.

- In Section 1, only complete this section if the certified rehabilitation was completed during tax year 2005. Provide the location of the property and the Maryland Historical Trust (MHT) project number.

- In Column 1, describe each certified heritage structure associated with your application, detailing its location.

- For Column 2, input the amount of certified rehabilitation expenditures for each property listed.

- In Column 3, apply the appropriate rate for each property: 25% for commercial structures rehabilitated during a specific timeframe or 20% for others, as detailed in the form.

- Multiply the expenditures in Column 2 by the rate entered in Column 3 and enter the result in Column 4.

- For Column 5, enter the amount from Column 4, ensuring that it does not exceed the maximum amount specified for each property.

- Complete Section 2 for current year credit or recapture, ensuring to enter the totals from Column 5 accordingly. If negative, denote this on the form.

- Finally, save your changes, download, or print the completed form and ensure to attach it along with the approved Heritage Preservation Certification Application when submitting your tax return.

Complete your documents online today to ensure timely processing and to take advantage of available tax credits.

Creating an expenditure list involves itemizing all expenses in a clear and organized manner. Start by grouping your expenses into categories, then note the date and amount for each. Maintaining a detailed expenditure list is a sound practice for anyone navigating the 502H guidelines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.