Loading

Get Mi 5049 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI 5049 online

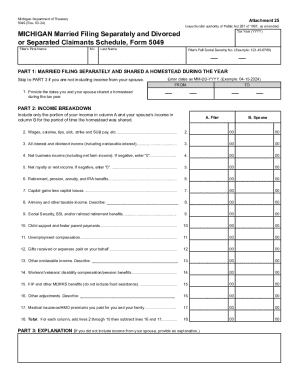

Filling out the MI 5049 is an important step for individuals who are married filing separately or are divorced or separated. This guide will walk you through the process of completing the form online, ensuring that you provide all necessary information to accurately calculate your total household resources for the Homestead Property Tax Credit.

Follow the steps to complete the MI 5049 online

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by filling in your first name, middle initial, last name, and social security number at the top of the form.

- Indicate the tax year for which you are filing the form. Use the four-digit format (YYYY).

- Move to Part 1 and provide the dates you and your spouse shared a homestead during the tax year. Enter these dates in the format MM-DD-YYYY.

- Proceed to Part 2, where you will report your income as well as your spouse’s income for the time you shared the homestead. Fill in the corresponding amounts in column A for yourself and column B for your spouse.

- Continue to enter data in each line for various income categories such as wages, interest, business income, and more, ensuring the correct amounts are listed for both you and your spouse.

- When you reach line 18, calculate the total of your incomes and subtract any applicable adjustments or premiums paid, entering the final amounts in both columns.

- If you did not include income from your spouse in Part 2, provide an explanation in Part 3 as required.

- Lastly, review all your entries for accuracy, then save your changes, download, print, or share the completed form as needed.

Start completing the MI 5049 online today to ensure your Homestead Property Tax Credit is accurately calculated.

Under the married filing separately status, each spouse files their own tax return instead of one return jointly. Instead of combining income, each person separately reports income and deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.