Get Amended Return Initial Return Final Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Amended Return Initial Return Final Return online

Completing the Amended Return Initial Return Final Return form online can seem daunting, but this guide provides straightforward, step-by-step instructions to help you navigate the process smoothly. Whether you are filing an amended, initial, or final return, following these detailed steps will ensure accurate submission.

Follow the steps to successfully complete your tax return online.

- Press the ‘Get Form’ button to access the Amended Return Initial Return Final Return form and open it in your preferred online editor.

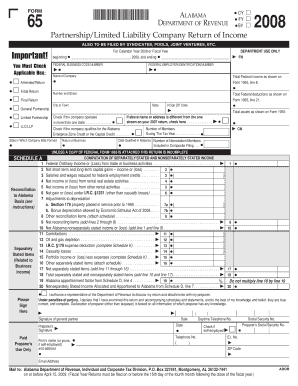

- Select the applicable box at the top of the form to indicate whether you are filing an amended, initial, or final return. Ensure that you provide the correct year for your filing.

- Enter the name of your company along with its address, including the city or town, state, and ZIP code.

- Indicate if the company operates in more than one state by checking the appropriate box.

- Provide the total federal income and total federal deductions as shown in Form 1065.

- Fill out the nature of business and the date qualified in Alabama. Also, specify the number of nonresident members and the number of members during the tax year.

- Complete the Reconciliation to Alabama Basis section by listing any separately stated items related to business income.

- Proceed to the computation of separately stated and nonseparately stated income, ensuring that all values are accurately entered from respective lines.

- Review all entered values for accuracy. Once complete, you can save your changes, download the completed form, print it for your records, or share it with relevant parties.

Start completing your Amended Return Initial Return Final Return online now to ensure timely and accurate filing.

To mark a return as amended, you need to complete Form 1040X and clearly indicate it is an amended return at the top of the form. You should also explain the changes and include any necessary back-up documents. This helps clarify your submission for the IRS and facilitates a smoother review of your amended return. Consider using uslegalforms for an efficient way to access the forms you need.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.