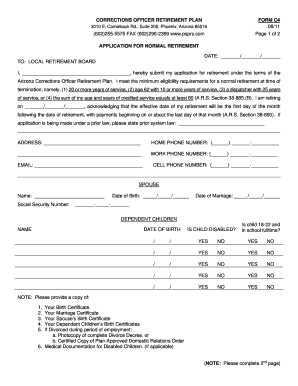

Get Form C4 - Application For Normal Retirement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM C4 - Application For Normal Retirement online

Filling out the FORM C4 - Application For Normal Retirement can seem daunting, but with clear guidance, you can complete it with confidence. This guide provides step-by-step instructions to help you navigate each section of the form to ensure a smooth application process.

Follow the steps to complete your retirement application online.

- Press the ‘Get Form’ button to access the application form and open it in your preferred editing tool.

- Enter the date of application in the designated field at the top of the form.

- Provide your full name where it asks for the applicant's name.

- Indicate your retirement date in the specified section, acknowledging that your retirement will become effective on the first day of the following month.

- Fill in your address, home phone number, work phone number, email, and cell phone number in the appropriate fields.

- Complete the spouse section by providing their name, Social Security number, date of birth, and date of marriage.

- List your dependent children by writing their names and dates of birth. Indicate if each child is disabled or if they are 18-22 and in school full-time by checking 'Yes' or 'No' for the relevant questions.

- Ensure you have copies of necessary documentation, such as your birth certificate, marriage certificate, and other required documents noted in the form.

- In the member's section, confirm leave(s) without pay and indicate any industrial leave received during your service. Provide the relevant information as requested.

- Read and sign the declaration regarding the truthfulness of the information provided, allowing the board to seek additional verification if necessary.

- Obtain the employer's certification of retirement date, including the employer's authorized signature and date.

- Review your completed form carefully for accuracy before saving your changes, downloading, printing, or sharing the completed application.

Take the next step towards your retirement—complete your application online today.

The time limit for amending a CT600 tax return typically follows the guidelines set by the tax authority, often within a year from the original submission date. Amending within this timeframe helps in avoiding penalties and ensuring accurate tax records. Taking proactive measures can significantly impact your financial situation. Platforms like uslegalforms provide valuable resources to help you navigate this process effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.