Loading

Get 1 2 3 4 5 6 7 8 9 10 11a B C 12 13 14 15 16 Initial Return Final Return Amended Return Address

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1 2 3 4 5 6 7 8 9 10 11a B C 12 13 14 15 16 Initial Return Final Return Amended Return Address online

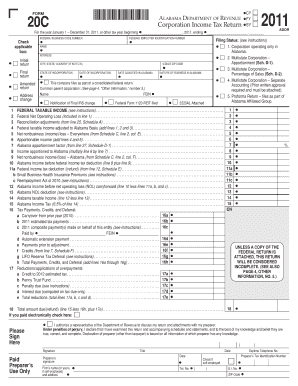

Filling out the 1 2 3 4 5 6 7 8 9 10 11a B C 12 13 14 15 16 form is essential for accurate tax reporting to the state of Alabama. This guide provides a detailed walkthrough on how to correctly complete each section of the form online.

Follow the steps to successfully complete your tax return form.

- Click ‘Get Form’ button to obtain the form and proceed to open it in your preferred browser.

- Fill in the relevant tax year or the period in which your business operated. You can choose to file as an Initial Return, Final Return, or Amended Return by checking the respective box.

- Enter the corporation name and address in the designated fields. Ensure that the address is accurate and complete.

- Select your federal business code number and federal employer identification number in the provided sections.

- Choose the filing status based on your corporation’s operation in Alabama. Options include single state operations, multistate operations requiring apportionment, or filing as part of a consolidated return.

- Complete the income sections which include lines for federal taxable income, net operating loss, and any reconciliation adjustments as required by the form.

- If applicable, include nonbusiness income entries, apportionable income, and respective calculations.

- Calculate the Alabama taxable income using the stipulated percentages and deductions as guided in the instructions provided with the form.

- Ensure to include any tax credits or payments that have been made prior to this tax return filing.

- Review all sections to confirm accuracy and completeness before finalizing the form.

- Save changes made to the form and choose to download, print, or share your completed form as needed.

Start filling out your 1 2 3 4 5 6 7 8 9 10 11a B C 12 13 14 15 16 form online today for accurate tax reporting.

Related links form

Form 1040 requires detailed information regarding your income, tax deductions, and credits. You'll need to report wages, salaries, interest income, and any other sources of income. Additionally, don’t forget to list deductions and attach any necessary schedules, as this will help determine your overall tax liability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.